November 8, 2024

Argentina's inflation rate has crossed even 250% in the recent times, creating unprecedented challenges for its 47 million citizens. This severe economic crisis forced Argentinians to seek alternative ways to protect their savings and maintain their purchasing power. The rapidly devaluing peso has pushed many residents toward digital currency solutions as they struggle to preserve their financial stability.

Stablecoins in Argentina have emerged as a practical tool for economic relief, offering a way to hedge against the peso's declining value. These digital assets, pegged to more stable currencies like the US dollar, provide Argentinians with easier access to international markets and more secure storage of value. The growing adoption of stablecoins in Argentina represents a significant shift in how citizens manage their money during this period of economic uncertainty.

Argentina's Economic Crisis

The economic landscape of Argentina reveals a persistent struggle with inflation spanning over four decades. Between 1980 and 2022, the country's inflation rate fluctuated dramatically, reaching a peak of more than 3,000% during the hyperinflationary period of the late 1980s. The average inflation rate during this period stood at 206% annually, highlighting the chronic nature of Argentina's monetary instability.

Historical context of inflation

Since gaining independence in 1816, Argentina has defaulted on its debt nine times, with three defaults occurring in the past two decades alone. The economic decline intensified after 1930 when political instability began to affect monetary policy. Despite these challenges, Argentina maintained a relatively strong economy until 1962, with a per capita GDP surpassing that of Austria, Italy, and Japan.

Current inflation rate and its impact

The present economic crisis has reached alarming proportions:

Monthly inflation hit 25% in December 2023

The peso has lost approximately 90% of its value against the US dollar in the past five years

The social impact has been severe, with over 40% of the population now living in poverty. Essential goods have become increasingly unaffordable, with food prices and energy costs surging by more than 200%.

The Rise of Stablecoins in Argentina

In response to Argentina's economic challenges, digital financial solutions have emerged as crucial tools for preserving wealth. Stablecoins, in particular, have become increasingly prominent in the country's financial landscape, offering a bridge between traditional currency and digital assets.

What are stablecoins?

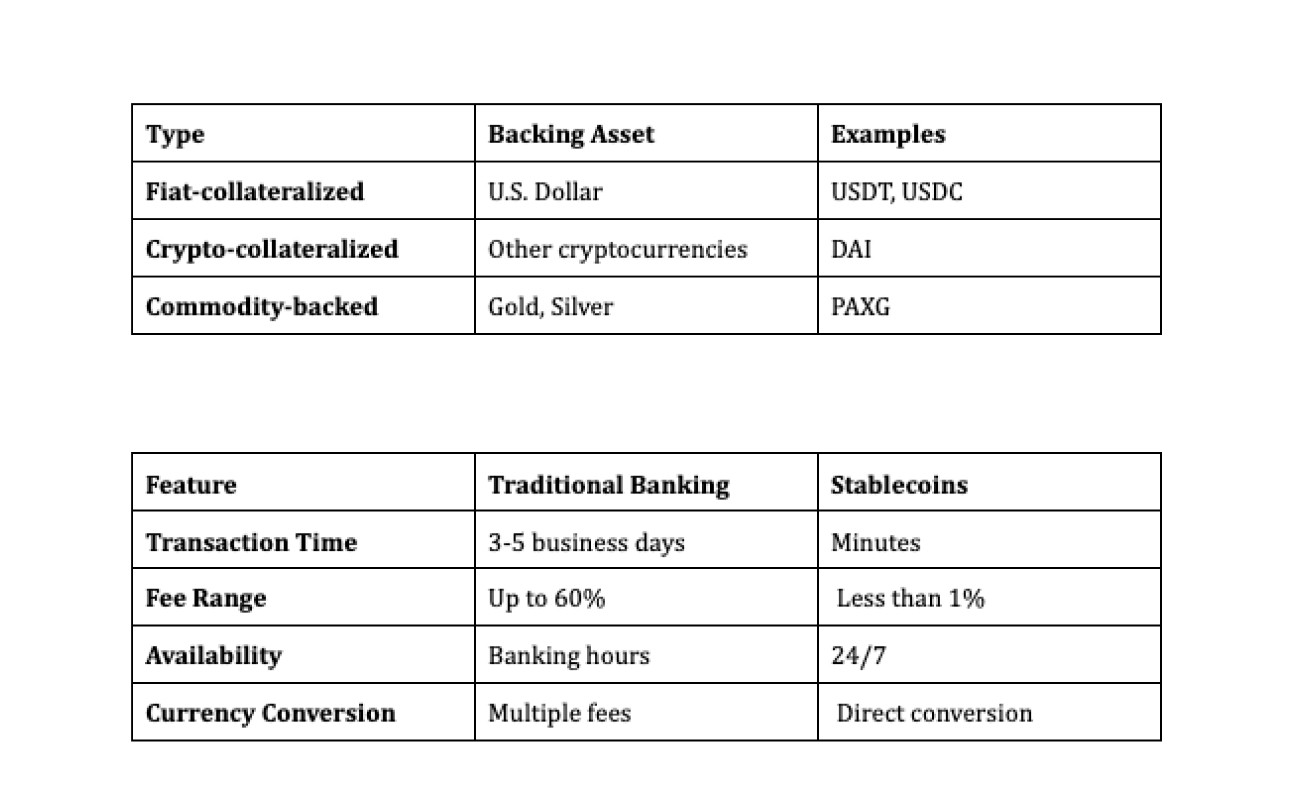

Stablecoins are cryptocurrencies designed to maintain a stable value by pegging themselves to external assets, typically the U.S. dollar. These digital tokens serve as a medium of exchange while providing the stability of traditional currencies.

Popular stablecoins used in Argentina

DAI has emerged as a leading stablecoin in Argentina, with its trading volume growing sixfold in recent years. The preference for DAI stems from its decentralized nature and reliable dollar-pegged value. Other widely used stablecoins in Argentina include:

USDT (Tether): Preferred for larger transactions between USD 5,000 and USD 10,000

USDC: Commonly used among institutional clients and investment funds

DAI: Popular among retail users and small businesses

The traditional cross-border payment landscape versus stablecoin solutions shows marked differences.

Adoption rates and usage statistics

Argentina's stablecoin market has demonstrated remarkable growth, with 61.8% of all cryptocurrency transactions involving stablecoins—significantly higher than the global average of 44.7%. This positions Argentina among the leading countries in Latin America for stablecoin adoption, surpassing Brazil's 59.8% share of transactions.

The adoption pattern shows distinct characteristics:

Retail-sized transactions (under USD 10,000) show the fastest growth rate

Peak trading activity occurs during the first week of each month, coinciding with salary payments

2.3 million DAI trading volume was recorded in a single month on one exchange alone

The surge in stablecoin usage in Argentina correlates directly with periods of peso devaluation. When the peso's value declined significantly in July 2023, stablecoin trading volume exceeded USD 1 million in the following month. This trend intensified in December 2023, with trading volumes surpassing USD 10 million after another sharp currency devaluation.

Institutional adoption has also gained momentum, with small and medium-sized businesses increasingly using stablecoins for reserve holdings and international payments. This trend highlights the growing recognition of stablecoins as a practical solution for preserving value and facilitating cross-border transactions in Argentina's challenging economic environment.

How Stablecoins Provide Economic Relief

Stablecoins have emerged as a vital financial tool for Argentinians seeking shelter from the country's economic turbulence. These digital assets provide practical solutions for preserving wealth and conducting international transactions in ways traditional banking systems cannot match.

Protection against peso devaluation

The correlation between peso devaluation and stablecoin adoption is striking as highlighted above. The stability offered by USD-pegged digital assets provides a reliable haven for savings, protecting against the peso's continuous depreciation.

Facilitating cross-border transactions

Stablecoins have revolutionized international payments for Argentine businesses and individuals. This efficiency has particularly benefited:

Freelancers receiving international payments

Small businesses engaging in global trade

Families sending or receiving remittances

Investors managing international portfolios

Amid Argentina’s persistent high inflation, USDs—an auto-yielding, 100% collateralized stablecoin—offers a powerful financial alternative for Argentinians seeking to preserve and grow their wealth. USDs provides a stable currency with reliable value and automatically generated yield, helping users accumulate returns without active management.

Unlike traditional savings in pesos, USDs safeguards purchasing power, and its collateral-backed structure ensures trust and stability, even as the national currency fluctuates. This unique combination allows Argentinians to shield their finances from inflationary pressures while earning passive income, all within a secure, decentralized framework.

Preserving purchasing power

The preservation of purchasing power through stablecoins has become crucial as Argentina's inflation rate continues to climb. A majority of stablecoins maintain their value by tracking the US dollar, providing a reliable store of value that operates independently of local currency fluctuations. This stability is reflected in the 61.8% share of stablecoin transactions in Argentina's crypto market—significantly higher than the global average of 44.7%.

The accessibility of stablecoins has democratized access to dollar-denominated assets. Anyone with a crypto wallet and internet connection can acquire and hold stablecoins, circumventing traditional banking restrictions. This has proven particularly valuable for:

Retail investors protecting their savings

Small businesses maintaining operating capital

Individuals managing daily expenses in a more stable currency

Merchants accepting international payments

The transparency of blockchain technology ensures all transactions are verifiable and immutable, adding an extra layer of security for users. This feature, combined with the round-the-clock availability of trading and transfer services, has made stablecoins in Argentina an increasingly attractive option for those seeking financial stability in uncertain times.

The impact extends beyond individual users to the broader economy. Businesses leveraging stablecoins in Argentina report significant operational efficiencies, particularly in managing international supply chains and vendor payments. The reduction in transaction fees and elimination of currency conversion hassles have enabled many Argentine companies to maintain competitive positions in global markets despite local economic challenges.

Challenges and Risks of Stablecoin Usage

While stablecoins offer significant benefits for Argentinians facing economic uncertainty, these digital assets present notable risks and challenges that require careful consideration. The growing adoption of stablecoins in Argentina's financial landscape has highlighted several areas of concern for users, regulators, and market participants.

Regulatory concerns

The regulatory framework for stablecoins in Argentina remains in development, creating uncertainty for users and service providers. The current landscape is characterized by a combination of openness and lack of comprehensive legislation. Besides removing tax on Bitcoin, President Milei's administration proposed the "Law of Foundations and Initial Measures for Argentinian Liberty" making significant changes to cryptocurrency taxation, including:

Exemption of cryptocurrency holdings from tax declarations

Capital gains tax only applying above specific thresholds

International transfer tax rates ranging from 5% to 15%

The absence of clear regulations has implications for consumer protection and market stability. While Argentina does not impose a blanket ban on cryptocurrencies, frequent warnings from regulators emphasize the high-risk nature of certain crypto investments.

Volatility of crypto markets

Despite their design for stability, stablecoins face various market-related challenges:

Security and fraud risks

The security landscape for stablecoin users presents multiple challenges that require vigilant risk management. Reports indicate that stablecoins were involved in:

70% of crypto scam transactions in 2023

83% of crypto payments to sanctioned countries

84% of transactions involving sanctioned individuals

The primary security vulnerabilities stem from:

Exchange Platform Risks

Cybersecurity breaches

Operational disruptions

Custody complications

User-Level Threats

Phishing attacks

Wallet compromise

Social engineering schemes

Systemic Challenges

Smart contract vulnerabilities

Protocol weaknesses

Settlement process risks

Law enforcement agencies have begun integrating cryptocurrency analysis tools to combat illegal activities. In a notable case, Argentine authorities seized USD 28,600 in stablecoins from a criminal organization involved in money laundering operations, marking the first operation of its kind in the country.

The financial stability implications extend beyond individual users to the broader market ecosystem. Stablecoins now account for a significant portion of crypto-asset trading volume, with the largest stablecoins becoming critical to market liquidity. This interconnectedness creates potential systemic risks, as issues with major stablecoin providers could trigger wider market disruptions.

Market integrity concerns include possible manipulation, insider trading, and front-running activities. The lack of standardized trading practices and price transparency can expose users to unfair trading practices. Additionally, the complex relationships between stablecoin issuers, trading platforms, and users can create conflicts of interest that may disadvantage retail participants.

To mitigate these risks, users must implement robust security measures and conduct thorough due diligence when selecting platforms and services. The transparency of blockchain technology provides some protection through transaction verification, but users must remain vigilant against evolving threats in this rapidly changing landscape.

Conclusion

Argentina's unprecedented inflation rate of more than 200% has pushed millions of citizens toward innovative financial solutions, with stablecoins standing out as a practical shield against economic uncertainty. These digital assets have proven their worth through efficient cross-border transactions, reliable value storage, and accessibility for both individuals and businesses. The significant adoption rate, marked by stablecoins comprising 61.8% of cryptocurrency transactions in Argentina, demonstrates their crucial role in helping citizens maintain financial stability during challenging times.

While regulatory concerns and market risks demand careful consideration, stablecoins continue to serve as essential tools for Argentinians seeking economic relief. Their growing acceptance among retail users and businesses signals a fundamental shift in how people manage money during periods of severe inflation. The Argentine experience highlights how digital currency solutions can provide practical financial alternatives when traditional systems face significant challenges, potentially setting an example for other nations grappling with similar economic pressures.