November 21, 2024

Transparency and open communication are core to our values. That's why we want to share the insights that led us to pause our pursuit of a Collateralized Debt Position (CDP) stablecoin. This decision follows an intensive three-month research period where we explored various avenues, including the possibility of licensing LUSD for Arbitrum. Ultimately, several factors contributed to our conclusion.

Challenges Specific to Our Context

Extensive Research & LUSD Exploration: We dedicated three months to deep analysis, evaluating the feasibility and sustainability of a CDP stablecoin. This involved extensive market research, technical assessments, and risk modeling. We even explored licensing LUSD for Arbitrum as a potential alternative, examining its mechanics and potential fit within our ecosystem.

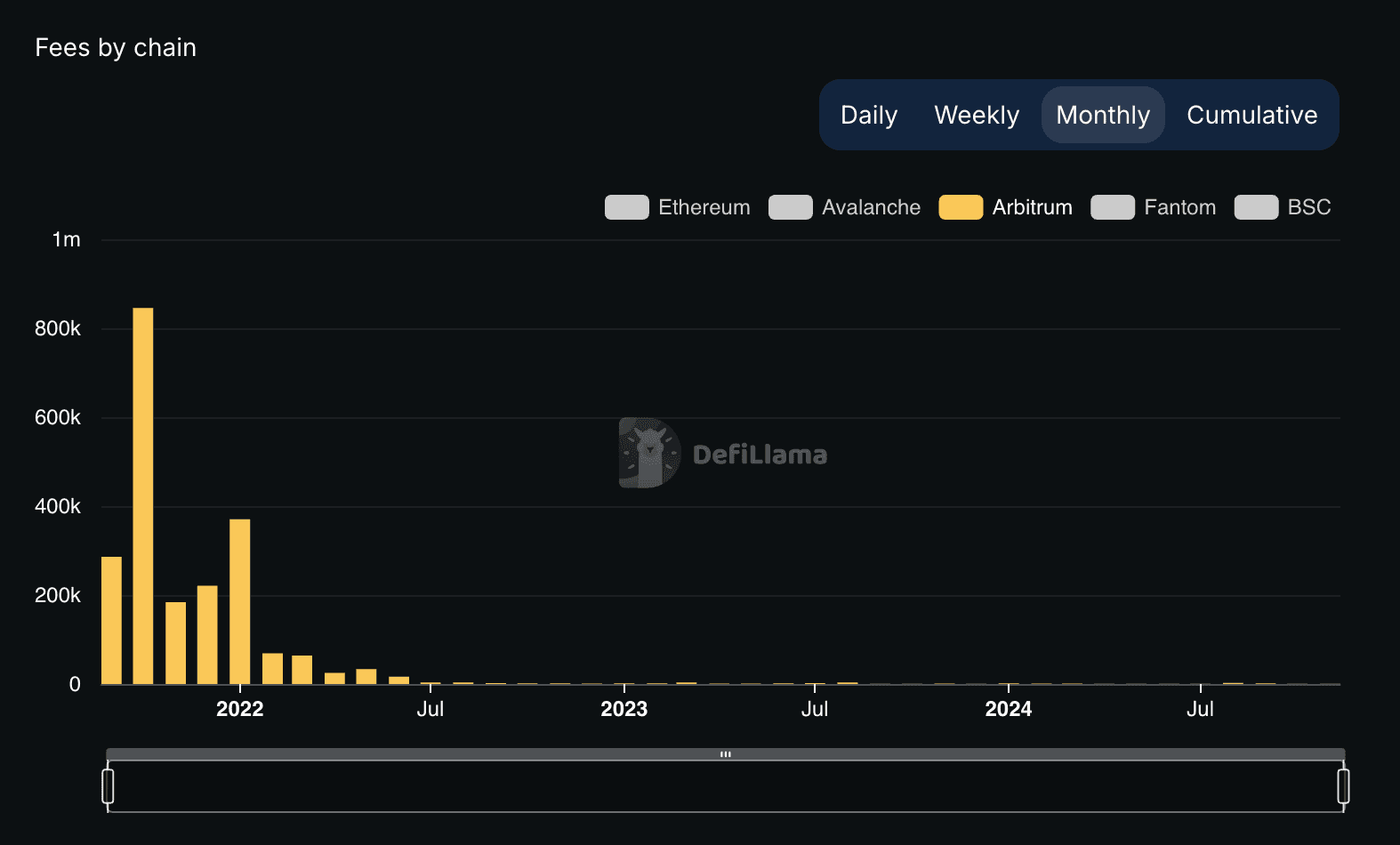

Low Layer 2 Revenues: A key factor in our decision was the projection of low revenue generation potential on Layer 2 solutions for CDP stablecoins. The costs associated with operating and securing a CDP system and the limited revenue streams in the current Layer 2 landscape made it challenging to establish a sustainable and economically viable model.

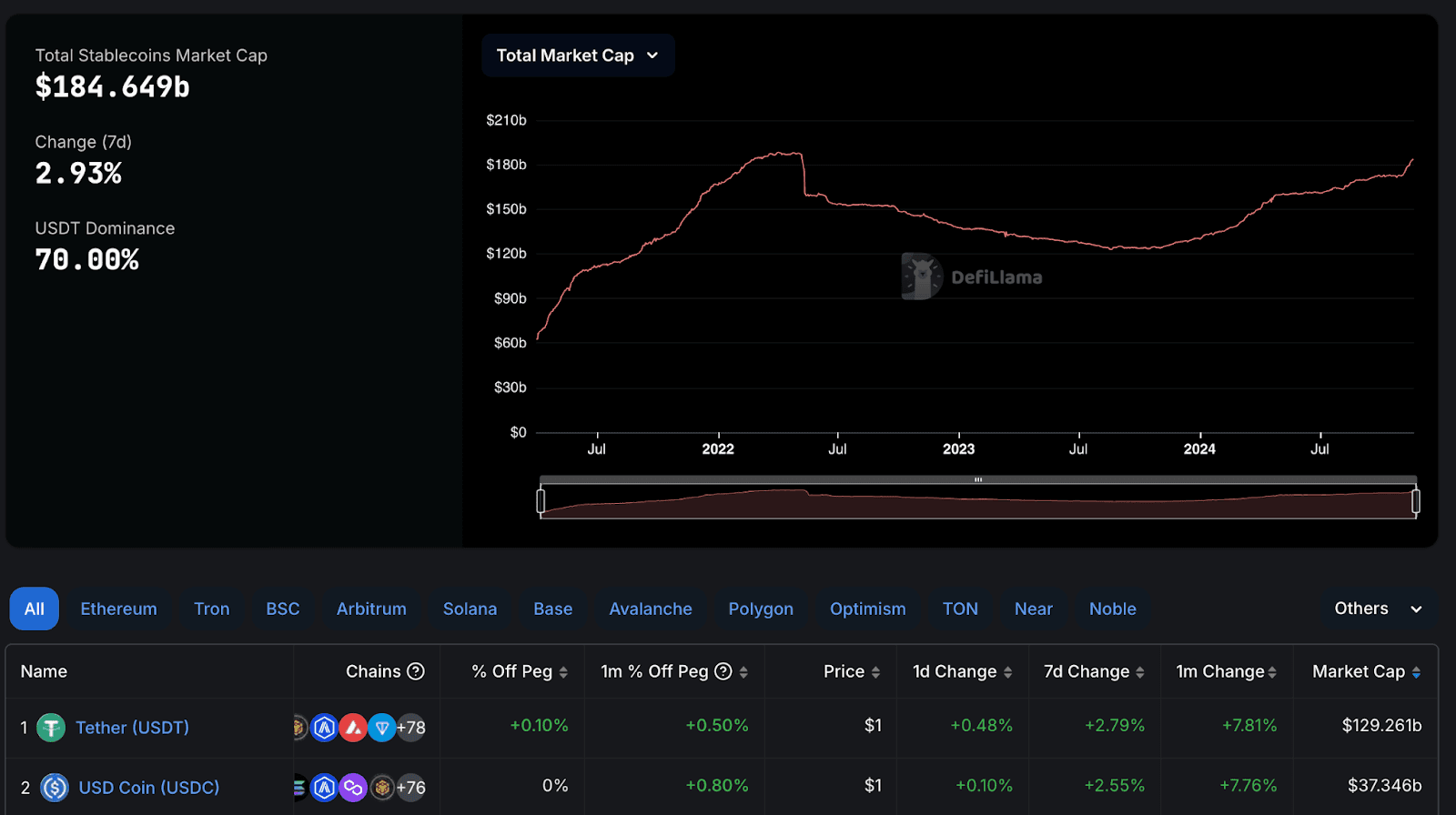

The stablecoin market cap on Arbitrum has been steadily increasing throughout the year from $2 Billion to over $5 Billion.

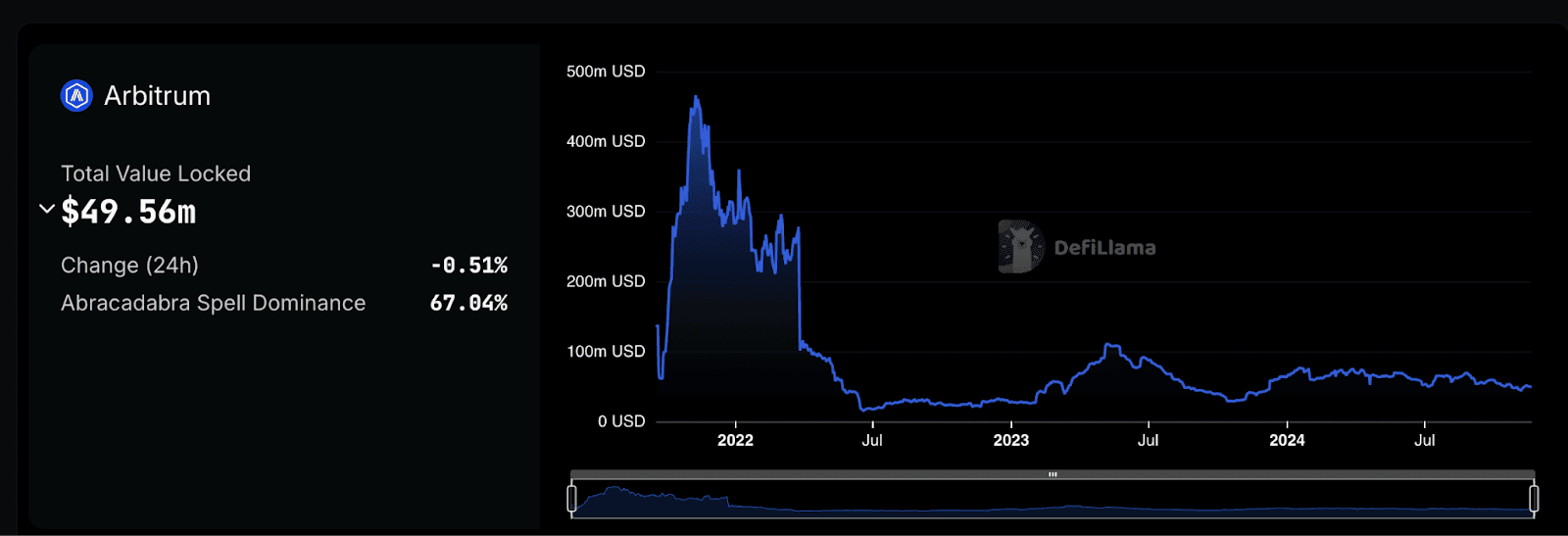

Since the start of the year, the CDP stablecoins' Market Cap and TVL have declined from $128 million and $67 million to $67 million and $49 million respectively.

The revenue generated by CDP stablecoins on Arbitrum is abysmal. DAI and USDe are not generating any revenues on Layer 2s.

Abracadabra’s revenue with MIM is dwindling as well.

Market Volatility: Crypto markets are inherently volatile. Rapid price drops can trigger mass liquidations, potentially destabilizing the entire system and harming users, which poses a significant risk for CDP stablecoins. Stablecoins have always been in a constant pegging battle. CDPs have improved resilience by accepting a wider range of liquid and stable collateral but we have a long road ahead. Synthetic dollars are potentially vulnerable to black swan events and persistently low funding rates during bear markets.

Complexity and User Experience: The mechanics of CDPs can be complex for average users to grasp. Managing collateral ratios, liquidation risks, and understanding the system's intricacies can create entry barriers and lead to unintended losses.

Our Commitment to Innovative DeFi Solutions - Introducing Ultimate Yield Optimiser

While we are pausing our CDP stablecoin project, our commitment to building innovative DeFi solutions remains stronger than ever. We believe in the transformative potential of blockchain technology and are excited to announce that we're channeling our energy and resources into a new direction: a yield optimisation product for stablecoin holdings in USDC and USDT as USDC and USDT dominate the stable market with $166 billion in a total market cap of $184 billion. The stablecoin holdings, especially in the developing nations, have been on a tremendous rise.

This product will empower users to maximize returns on their stablecoin assets while prioritizing security and ease of use. We're confident this new venture will provide significant value to our community and contribute to a more inclusive and accessible DeFi landscape. We will run a poll within our community for name finalization.

Looking Ahead

Committed to providing our users with the best opportunities for passive income, our platform will continue to feature Sperax's USDs as a core component of our yield optimization strategies. USDs's robust stability mechanisms and security make them a secure and reliable asset for generating consistent returns. Users can maximize the potential of USDs to achieve their financial goals. USDs will remain a cornerstone of our platform, providing a solid foundation for users to navigate the evolving DeFi landscape confidently and achieve their long-term investment objectives.

This shift to developing a new product allows us to leverage our expertise and resources to address a pressing need in the market: providing users with reliable and efficient ways to generate yield on their stablecoin holdings. We're eager to share more details about this exciting new product in the coming days. Stay tuned for updates!

We value your understanding and support as we navigate this evolving landscape. We're confident this new direction will lead to even greater innovation and value for our community.