November 25, 2024

1. Introduction

The rise of decentralized finance (DeFi) has unlocked new opportunities for investors to earn passive income on their digital assets. Stablecoins, cryptocurrencies pegged to stable assets like the US dollar, play a crucial role in the DeFi ecosystem. The Arbitrum Chain, a layer-2 scaling solution for Ethereum, has emerged as a popular platform for DeFi protocols due to its lower gas fees and faster transaction speeds. Currently ranked 4th in market cap behind giants like Ethereum, Tron, and BSC, Arbitrum boasts a thriving DeFi ecosystem.

Notably, the total stablecoin market cap on Arbitrum has reached an impressive $4.465 billion, with USDT and USDC dominating the market with $2.765 billion and $1.557 billion respectively. This presents a significant opportunity for users to optimize their stablecoin yields, especially given that the 7-day average APY on USDT and USDC has varied between 1.88% and 6.34%. Furthermore, over 17 billion dollars are invested into about 250 stablecoin pools across 450 protocols on Arbitrum, with yields ranging from 0% to 122% across various risk domains. This highlights the vast potential for yield optimization and the complexity and risks involved. This paper proposes a product that simplifies yield optimization for stablecoin holders on the Arbitrum Chain through a user-friendly and accessible platform.

2. Problem Statement

Currently, users seeking to optimize their stablecoin yields on Arbitrum face several challenges:

Protocol Research and Selection: Identifying and evaluating the vast array of DeFi protocols and their associated risks is time-consuming and requires technical expertise. With over 450 protocols offering yield opportunities, the research process can be overwhelming for most users.

Strategy Diversification: Manually diversifying stablecoins across multiple protocols and strategies to balance risk and reward is complex. Managing investments across 250 stablecoin pools with varying risk profiles requires significant effort and knowledge.

Impermanent Loss: Participating in liquidity pools, associated with alt tokens for high rewards, exposes users to the risk of impermanent loss, potentially negating yield gains. Understanding and mitigating this risk is crucial for successful yield farming.

Yield Variance: With yields ranging from 0% to 122%, identifying the optimal strategies for a given risk tolerance and investment horizon can be challenging.

Dynamic Market Conditions: The DeFi landscape constantly evolves, with new protocols and strategies emerging regularly. Keeping track of these changes and adjusting investment strategies can be difficult.

Trust Factor: USDT remains the most dominant and trusted stablecoin. With close to 70% of the market, USDT is the most liked stablecoin. In the current market landscape, it becomes very difficult to build trust and acquire users for a new coin.

3. Proposed Solution

Our product addresses these challenges by offering a user-friendly platform for automated yield optimization on Arbitrum. Users can invest their stablecoins (USDC or USDT) based on their preferred investment duration and risk tolerance. The platform then intelligently allocates the funds across various strategies, maximizing yield while mitigating risks. When users are ready to redeem their investment, they will receive their funds back in the USDC or USDT.

Protocols that abstract away the technical complexities of DeFi are essential for mainstream adoption. Users could invest capital in DeFi protocols without manually handling multiple token transactions, staking requirements, or wallet management. As institutional participation increases, these protocols will become indispensable for portfolio managers looking to optimize yield across multi-chain ecosystems.

Portfolio optimization, or portfolio management problem, which concerns the determination of the best portfolio (asset distribution) out of all sets of portfolios available under certain constraints, is regarded as the core problem in the field of fund management.

A fundamental approach to solve this question is posed by Markowitz, in which he advocates the mean-variance model to formulate the problem as an optimization problem entailing two criteria: (i) the reward (measured basically by return, and should be maximized), and (ii) the risk (measured by the variance of return, and should be minimized). There doesn’t exist a single optimal solution (portfolio), as there are two criteria to consider, but a set of optimal portfolios, i.e. efficient portfolios.

Putting the theory of Markowitz at the core, a myriad of papers have been issued by enhancing or reshaping the basic model in the following three ways : (i) the simplification of the size and type of input data; (ii) the replacement of the measures of risk; and (iii) the introduction of further criteria or constraints

Categories of strategies into consideration

Instant liquidation strategy: A combination of strategies with instant redemption without any penalty or deductions

30-day redemption: A combination of strategies within a maximum of 30 days redemption cycle

Fixed Strategy: A combination of strategies with a predetermined period

Strategies will be optimized to provide the maximum benefit to a user.

Risk Optimization

Users can choose a risk factor for their investment on a scale of 1 to 5, with 1 being the safest and 5 being the riskiest strategy. A user’s investment will be optimized based on risk factors associated with the underlying strategies.

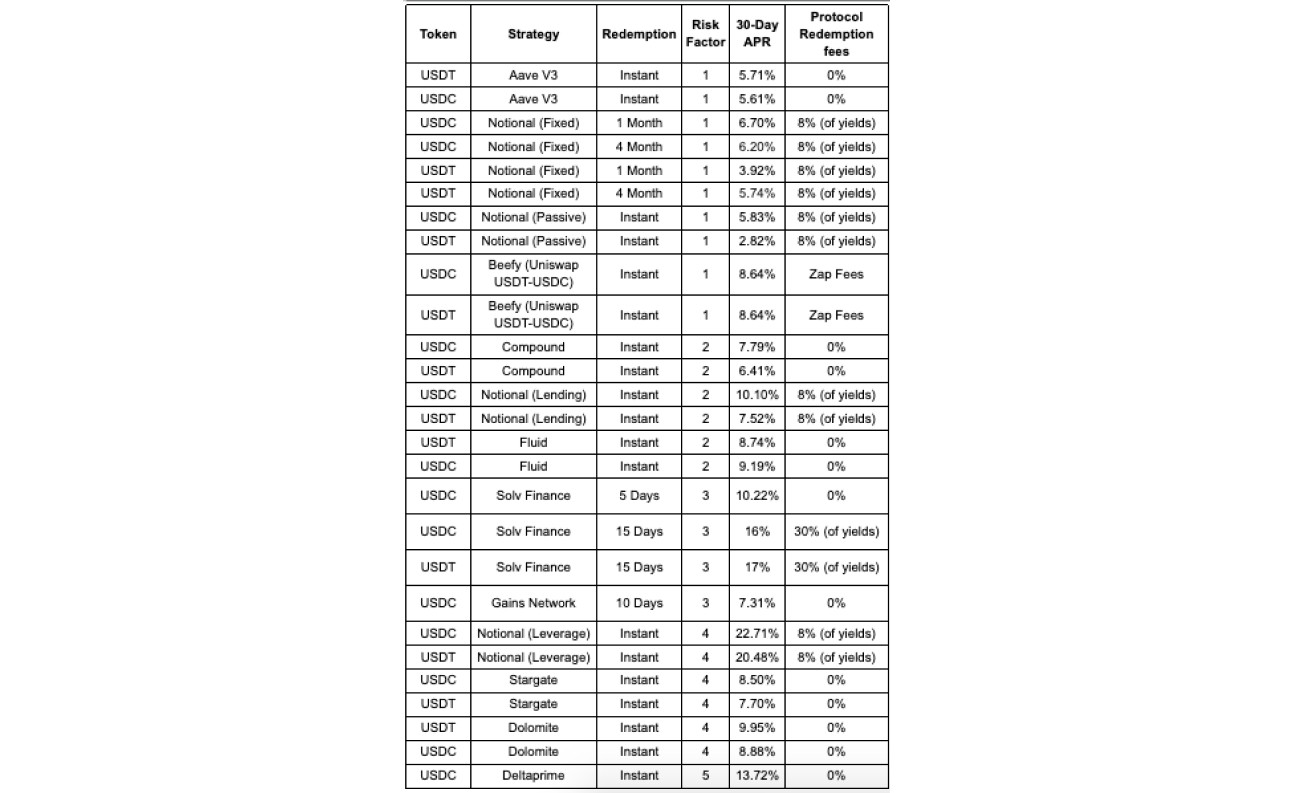

Examples of said strategies, the associated risk factors, and the corresponding last 30-day APRs

Viability

This yield optimization platform addresses a clear and present need within the Arbitrum DeFi ecosystem. With billions of dollars in stablecoins seeking optimal returns, our product simplifies the complexities of yield farming, making it accessible to a wider audience. Yield optimizer is one of the 8 major trends to watch out for.

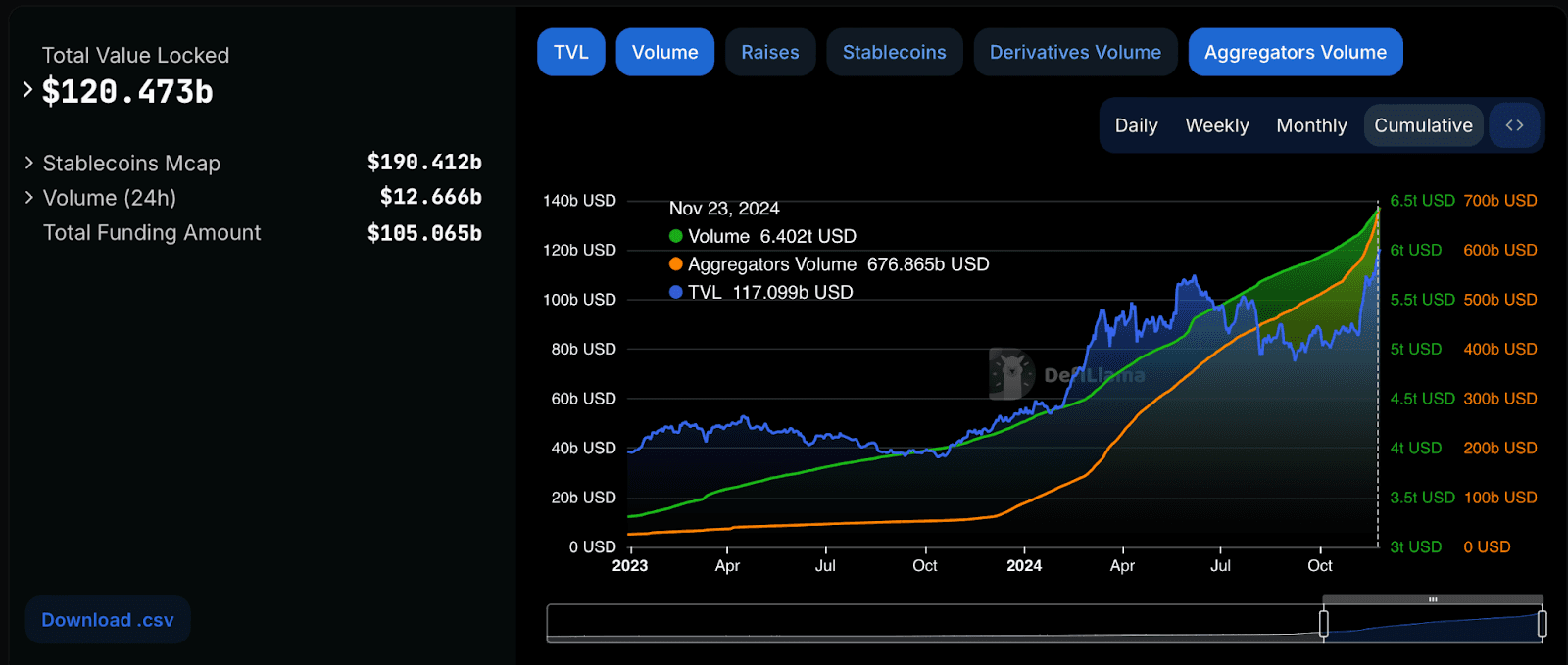

As we can see the Stablecoin TVL, Volumes, and Aggregators volumes have been at all-time highs in the last two years. (Source - DefiLlama)

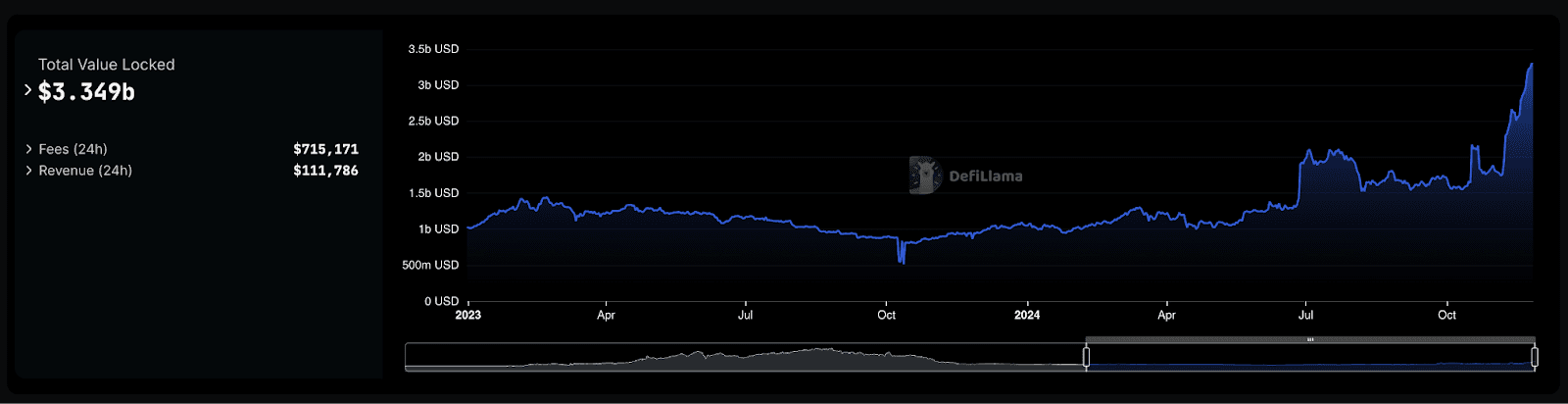

There has been a prominent rise in the TVL of all yield aggregators in the last two years. (Source - DefiLlama)

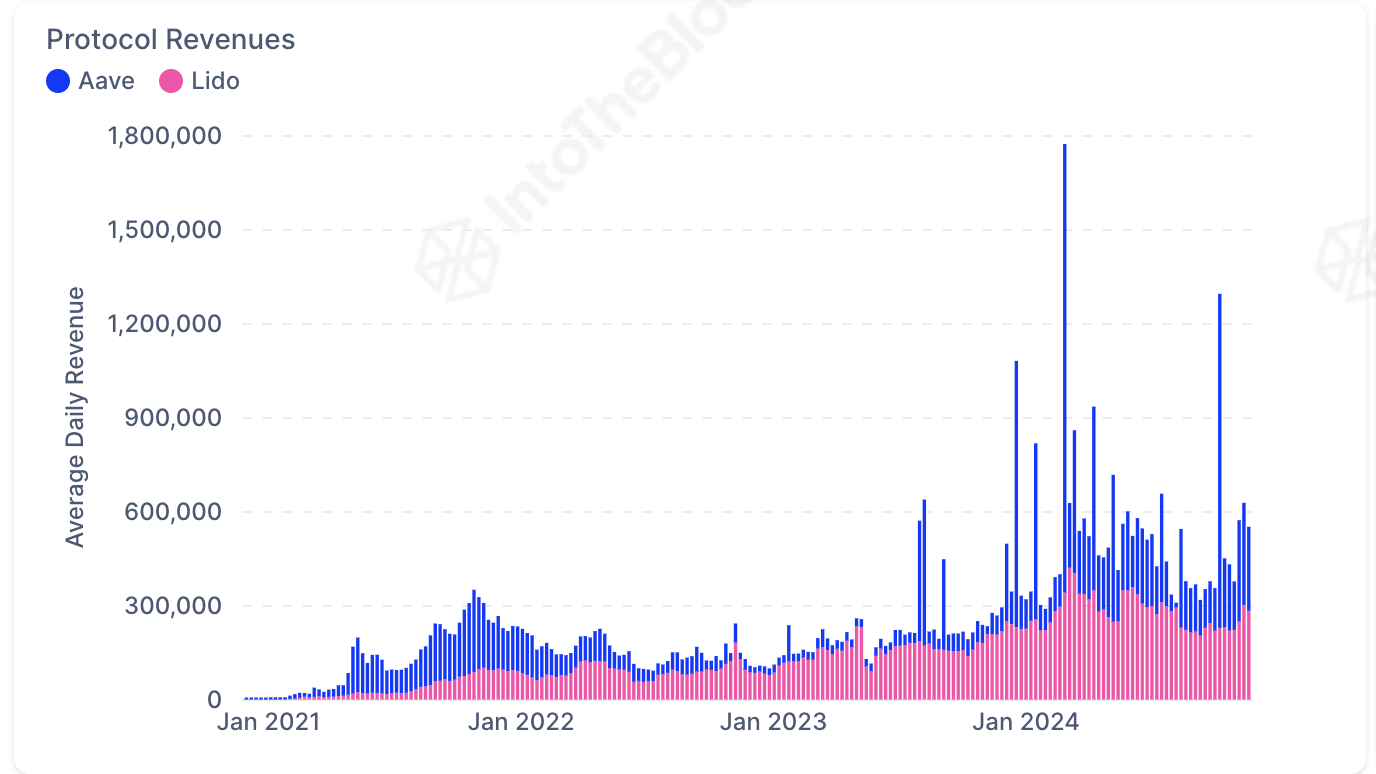

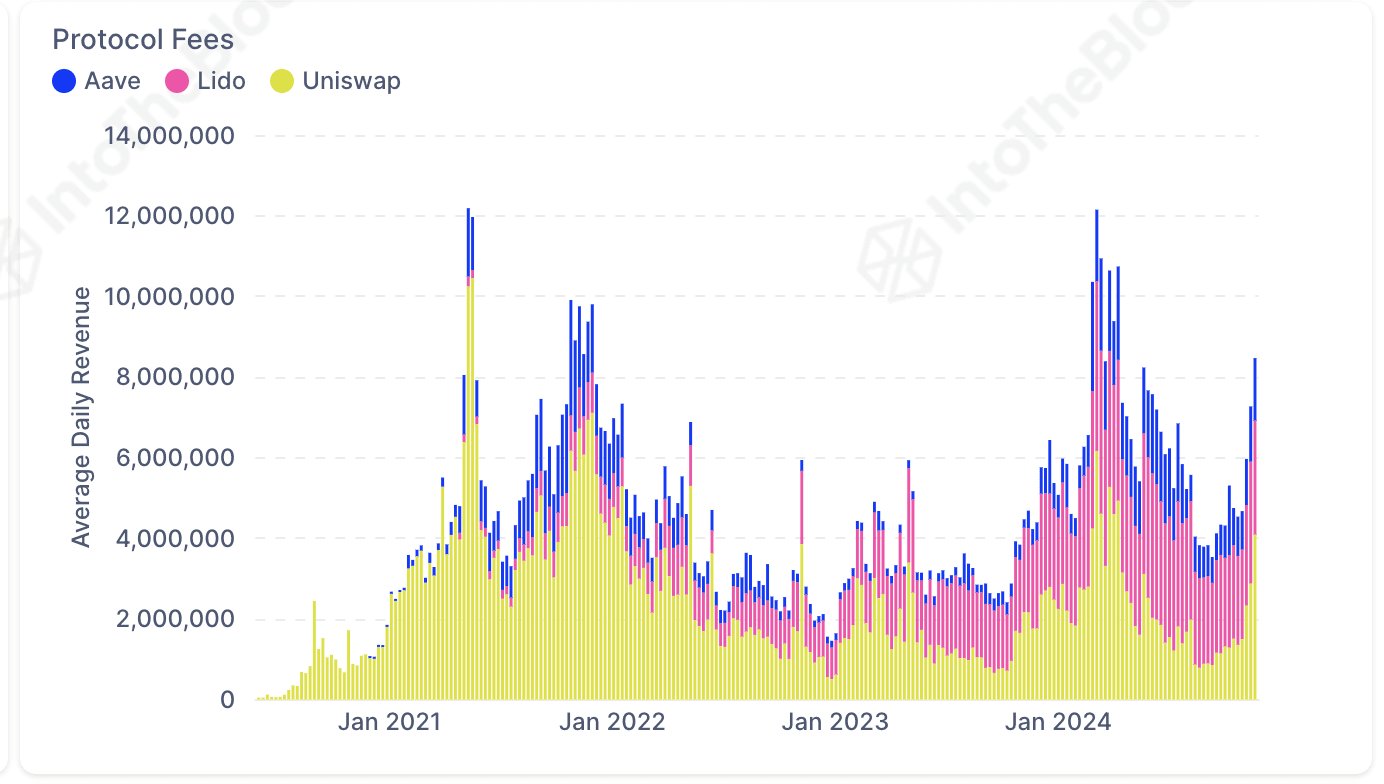

We are also seeing a tremendous rise in the revenue and fees generated by the few most prominent strategies employed by these yield aggregators e.g. Aave, Lido, and Uniswap. (Source - IntoTheBlock)

4. Key Features

User-Friendly Interface: A simple and intuitive interface allows users to easily deposit stablecoins, select their investment preferences, and monitor their portfolio performance. The platform will focus on ease of use and accessibility, even for users new to DeFi.

Mobile-First Design: Recognizing the growing importance of mobile accessibility in the DeFi space, our platform will feature a responsive design optimized for mobile devices. This will allow users to manage their investments and monitor their portfolios.

Risk Management: The platform incorporates risk management measures to minimize potential losses due to impermanent loss, smart contract vulnerabilities, and market volatility. This includes diversification across protocols and strategies and real-time monitoring of risk factors.

Yield Optimization: The system continuously monitors and adjusts the allocation of funds to maximize yield based on real-time market conditions, risk associated with underlying strategies, and the dynamic landscape of Arbitrum's DeFi ecosystem.

Transparency and Security: Users fully understand the platform's strategies and performance. Robust security measures protect user funds from potential threats.

5. Key Differentiators

USDT/USDC Maximalist Focus: Designed specifically for users primarily holding and utilizing USDT or USDC

Universal Wallet Compatibility: Access our dApp with any wallet type (EOA, Hardware, Smart, etc.)

Auto-Bridging Integration: Invest directly from any chain with seamless cross-chain transfers.

Simplified Investment Process: Choose only three parameters:

Token (USDC or USDT)

Category (Instant, 30 days, fixed)

Risk (1 to 5) or maximize growth

One-Click Redemption: Effortlessly redeem your invested tokens (USDC/USDT) with a single click

6. Target Audience

This product caters to a broad range of users, including:

Retail User: Users looking to hold their money in the safest and least volatile currency to safeguard themselves from their fiat currency’s volatility or devaluation

Individual Investors: Cryptocurrency holders seeking to earn passive income on their stablecoin holdings, particularly those already utilizing the Arbitrum network

DeFi Beginners: Users new to DeFi who want a simplified way to participate in yield farming on Arbitrum

Risk-Averse Investors: Individuals looking for stable returns with minimal risk exposure

7. Marketing and Growth Strategy

Our marketing efforts will focus on:

Community Building: Engaging with the Arbitrum and DeFi communities through online forums, social media, and AMAs, building a strong presence within the target audience

Content Marketing: Creating educational content explaining the benefits of stablecoin yield optimization on Arbitrum, highlighting the platform's features and advantages

Partnerships: Collaborating with other DeFi protocols and influencers within the Arbitrum ecosystem to expand reach and user acquisition

8. USDs will remain the king of passive yield

Sperax's USDs will continue being the cornerstone for users seeking to earn passive yield. By seamlessly integrating USDs into our diverse range of yield optimization strategies, we empower users to capitalize on its unique stability mechanisms and deep liquidity within the Arbitrum ecosystem. USDs will remain the ideal stablecoin for generating consistent and reliable passive income.

9. Governance & Revenue

Our platform embraces a community-driven approach to governance, empowering veSPA holders to actively participate in shaping its future. All the decisions including the integration of new yield optimization strategies, revenue generation mechanisms, and the allocation of platform revenue will be decided via the governance mechanism. This ensures that the platform evolves in a way that aligns with the interests of its users and fosters a sustainable ecosystem for maximizing passive yield opportunities.

10. Naming

We believe in the power of community and want our users to be actively involved in shaping the identity of our product. To that end, we will be conducting a poll within the Sperax community to determine the best possible name for our yield optimization platform. This collaborative approach ensures that the final name resonates with our users and reflects the platform's core values of simplicity, accessibility, and community-driven governance.

11. Conclusion

This product offers a compelling solution for simplifying stablecoin yield optimization. By automating strategy selection, managing risk, and providing a user-friendly experience, particularly through a mobile-first design and automated rebalancing, we aim to empower users to achieve their financial goals in the DeFi space while capitalizing on the growth and opportunities within the Arbitrum ecosystem. The focus on USDC and USDT for investment and redemption further enhances the platform's accessibility and convenience for a wide range of users.