February 13, 2025

In the dynamic realm of cryptocurrencies, stablecoins have carved a niche for themselves by offering the best of both worlds—stability akin to fiat currency and the technological advantages of blockchain. USDC, or USD Coin, epitomizes this balance by serving as a reliable mode of exchange while also offering opportunities for earning yield.

Yet, many aspiring investors face the challenge of navigating the multitude of platforms and methods available for maximizing returns on their stablecoin holdings. Throughout this article, we'll explore various avenues—from centralized exchanges to DeFi protocols—while also highlighting the benefits and considerations of using USDC within these ecosystems.

Whether you're a seasoned investor or new to the world of cryptocurrency, you'll gain insights into not just the 'how,' but also the 'where' and 'why' behind earning yield on stablecoins like USDC. Join us as we map out the possible paths to financial growth using a stable cornerstone in crypto finance.

Understanding USDC and Stablecoins

USDC, short for USD Coin, is a stablecoin meticulously designed to maintain a 1:1 value with the US dollar. Created by Circle, USDC has become a popular choice among those looking to earn yield because it combines the reliability of fiat currency with the benefits of blockchain technology. Circle maintains safe and transparent reserves for USDC, consisting primarily of cash and short-dated U.S. Treasury securities. Independent accounting firms regularly attest that Circle backs every USDC token with a corresponding amount of fiat currency.

The appeal of USDC extends far beyond just stability. In the world of decentralized finance (DeFi), stablecoins like USDC act as a bridge, facilitating payments, remittances, and various financial services with the added comforts of lower volatility. Unlike traditional cryptocurrencies, which often experience sudden and dramatic price fluctuations, USDC holds its value, making it a reliable medium for both earning and lending within the crypto ecosystem.

Advantages of Using Stablecoins to Earn Yield

Higher Returns: Compared to traditional savings accounts, stablecoins often yield higher returns, especially when invested through DeFi platforms or centralized exchanges. According to a report by Circle, USDC's widespread adoption and demand have increased its viability as a lending asset, allowing platforms to offer attractive interest rates.

Stability: The inherent stability of USDC, underpinned by regular audits and backed by liquid assets, ensures that investors do not face the wild price swings typical of other cryptocurrencies. This stability makes it an appealing choice for yield farming, where consistency over time is crucial. For more insights into how USDC maintains its stability and compliance, the Circle report offers valuable information.

Low Overhead Costs: With fewer intermediaries involved in crypto transactions compared to traditional financial systems, more of the profit generated is returned to the investor. This efficiency translates into higher yields for those investing in USDC.

Despite the benefits, it is essential to recognize potential fluctuations and considerations. Market conditions and demand dynamics can affect the yields you earn from USDC, just like with any financial instrument. The performance of DeFi platforms and external factors also play roles in determining potential returns. Additionally, while USDC itself is stable, the platforms utilized for earning yield might present risks, such as smart contract vulnerabilities or liquidity challenges. Always carefully assess the platform's reputation and security when choosing where to invest.

Earning Yield Through Centralized Exchanges

USDC, or USD Coin, is a stablecoin designed to maintain parity with the US dollar, ensuring that each token is backed by an equivalent amount of real currency. Developed by Circle, it employs blockchain technology to offer a secure and efficient digital currency, making it appealing for earning yields, especially through centralized exchanges. USDC holds a significant advantage due to its backing by transparent reserves and regular audits, providing users with a stable and reliable store of value.

Stability of USDC

One of the primary appeals of USDC is its stability. Unlike more volatile cryptocurrencies, stablecoins like USDC provide predictable returns, reducing the risk of sudden value drops. This makes them an excellent option for earning yields through lending, staking, or other financial strategies. With a stable value, it becomes much easier to plan and manage passive income, offering a reliable alternative to more traditional savings methods. For instance, platforms like Coinbase provide a notable approximately 4% Annual Percentage Yield (APY) on USDC holdings, showcasing the potential for passive income without the unpredictability of volatile crypto assets.

Stablecoins are particularly advantageous for investors looking to diversify their portfolios. During both bull and bear markets, they maintain value relative to the US dollar, providing a cushion against market swings. This diversification helps reduce exposure to more unstable assets while still offering the opportunity for attractive yields. Additionally, the liquidity and widespread utilization of USDC across multiple blockchains and platforms enhance its utility. The ease of moving between platforms and participating in various financial operations further solidifies its position as a prime candidate for earning yields.

While the inherent stability of stablecoins provides a significant advantage, certain considerations should be taken into account. The yields available on platforms often fluctuate based on market dynamics and the general health of the DeFi ecosystem. It's essential to be vigilant about the risks associated with the platforms themselves, such as smart contract vulnerabilities, even when the stablecoin value is constant. Nonetheless, centralized exchanges offering yield on USDC position themselves as a strategic choice for those seeking a more predictable and less risky avenue for generating passive income.

Using Custodial Lending Services

USDC, or USD Coin, is gaining traction as a stable and efficient digital currency, finding its niche within both centralized and decentralized finance sectors. This stablecoin stands out due to its 1:1 backing with the US dollar, maintained through transparent reserves held in the Circle Reserve Fund. This fund's reserves are regularly validated by an independent accounting firm, ensuring users that each USDC token is securely backed by an equivalent amount in fiat currency.

When it comes to earning yield on USDC, custodial lending services present a robust option. These services operate on a centralized finance (CeFi) platform. By lending your USDC to a centralized provider, you essentially allow the provider to lend it out further to users or traders, gaining interest in return. This process can transform idle USDC holdings into a stream of passive income.

Stablecoins like USDC stand apart due to their comparative stability. Unlike volatile cryptocurrencies, USDC's value doesn't fluctuate significantly, offering a predictable investment landscape. This stability is a substantial advantage, reducing the risk of sudden, massive value fluctuations and making stablecoin yield farming a calmer and more predictable venture. It's this stability that not only makes USDC yield farming appealing but also allows higher returns than traditional savings accounts. CeFi platforms often incentivize users with better rewards, making stablecoins an attractive avenue for those seeking passive income without the stress of active trading.

However, while the value of stablecoins could remain steady, the yields they generate can vary based on current market conditions, platform performance, and user demand. It's crucial for investors to remember that, despite stablecoins' reduced volatility, custodial services may impose higher fees and stricter verification protocols, which could impact overall yields.

In the custodial lending space, ensuring the reliability and security of the service provider is paramount. While CeFi platforms often handle various processes seamlessly, the dependency on a centralized provider could add layers of risk. As such, users should exercise due diligence in selecting reputable platforms to shield themselves from these potential pitfalls. For anyone venturing into using USDC within custodial lending services, understanding both the appeals and risks is key to making informed financial decisions.

Non-Custodial Lending Platforms

USDC, or USD Coin, is a stablecoin pegged 1:1 to the US dollar. It's particularly appealing for earning yield due to its stability and the transparency in its backing. Unlike traditional savings where interest rates are low, using USDC on decentralized finance platforms provides a unique opportunity to earn higher yields by lending or staking. This process offers a steady stream of passive income as investors maintain control over their digital assets.

Description and Appeal of USDC

Stablecoins like USDC offer higher returns compared to traditional financial instruments. DeFi platforms incentivize their use by providing yield opportunities that often surpass those of stubbornly low-rate savings accounts in traditional banks. For example, non-custodial platforms like Aave and Compound can offer stable yields as discussed in Reddit thread here. In some instances, platforms like Kamino Finance offer even higher yields.

Advantages of Using Stablecoins for Earning Yield

The primary allure of using USDC in this context is its comparative stability. Unlike other cryptocurrencies that are subject to wild price swings, USDC remains consistent, creating a more predictable yield farming environment. This low volatility is advantageous as it shields investors from the emotional and economic upheavals that can result from overnight value shifts often seen in more volatile digital assets.

Potential Fluctuations and Stability Considerations

While USDC itself is stable, the yields it can generate are subject to fluctuations based on various market conditions such as platform performance and liquidity demand. Investors must be aware of the potential risks associated with DeFi platforms, including smart contract vulnerabilities and liquidity risks. Even though stablecoins are stable, the platforms used for earning yields may have their own set of inherent risks like unexpected liquidity changes or smart contract malfunctions. Strategies such as concentrated liquidity in automated market makers like Uniswap V3 can impact stability and returns significantly.

In terms of ensuring returns, it's crucial to diversify across multiple platforms and stay updated on the health and safety of the DeFi ecosystems engaged with. Awareness of such factors can help manage risks and set realistic expectations on yield earnings through USDC on non-custodial platforms.

DeFi (Decentralized Finance) Protocols

USDC (USD Coin) presents a compelling choice for investors seeking stability while engaging with DeFi protocols. DeFi protocols facilitate a wide range of financial activities using USDC, such as lending, borrowing, and liquidity provision, ensuring diverse use cases that can be tapped into by investors.

Advantages of Using Stablecoins Like USDC

One of the notable advantages of using stablecoins like USDC is the potential for high returns. Unlike traditional savings accounts, DeFi platforms often offer superior rewards as an incentive for user participation. This aspect is well-detailed in a YouTube video where high-yield staking strategies using stablecoins are explored, providing potential insights into maximizing returns.

Stablecoins offer comparative stability, which is crucial when engaging with yield farming. The price stability of USDC alleviates concerns over sharp devaluation, offering a more predictable environment for earning yields. This stability can be particularly advantageous in uncertain economic conditions, ensuring a calmer experience for investors.

Moreover, USDC facilitates cost-effective transactions. The stable nature of its valuation ensures that assets within liquidity pools remain steady, reducing transactional risks in DeFi ecosystems. This is crucial when utilizing stablecoins within protocols like Aave, which is known for its innovative flash loans and borrower flexibility.

Potential Risks and Stability Considerations:

Despite their inherent stability, engaging with stablecoins in DeFi protocols is not devoid of risks. The yields obtainable from stablecoins can vary based on supply-demand dynamics within these protocols. Reddit discussions highlight strategies such as Aave GHO staking and the potential for optimized yields through platforms like Morpho.

Such platforms may offer high yields under certain configurations, although investors should remain vigilant regarding fluctuations tied to market conditions.

Additionally, platform-specific risks need consideration. These include potential vulnerabilities in smart contracts or impermanent losses during liquidity provision. Choosing reputable and secure platforms can help mitigate these risks, ensuring that investments made in stablecoins like USDC remain secure.

Overall, while USDC's stability makes it a valuable asset in DeFi protocols, recognizing the landscape's dynamic nature and understanding associated risks remain crucial for optimizing yield and maintaining investment security.

Earn by Staking USDC

Earning yield on USDC through staking typically involves depositing your USDC into a decentralized finance (DeFi) protocol that offers staking rewards. Unlike traditional staking, where tokens are locked to secure a blockchain network, USDC staking generally refers to lending your stablecoins to liquidity pools or yield-generating platforms. Protocols like Aave, Compound, and Lido allow users to stake USDC in exchange for interest, which is earned from borrowers or other yield-generating mechanisms. Some platforms also offer auto-compounding rewards, maximizing returns. However, it’s essential to assess risks like smart contract vulnerabilities and platform security before staking USDC.

Yield Farming

Yield farming with USDC presents a compelling avenue for generating passive income, especially appealing to those wary of the volatility typically associated with cryptocurrencies.

Benefits of Using USDC for Yield Farming

One of the primary benefits of using stablecoins like USDC for yield farming is the potential for high returns. This high yield potential, combined with the comparative stability of stablecoins, creates an attractive proposition for investors seeking passive income.

The stable nature of USDC means investors need not fret about waking up to drastic overnight value changes, making this investment path more predictable and less stressful. However, it is essential to consider potential yield fluctuations as they are affected by the supply and demand dynamics within DeFi platforms. As more assets are supplied to the platforms, yields can decrease, influencing overall returns.

Earning yield on USDC through farming involves providing liquidity to decentralized finance (DeFi) platforms that offer yield farming opportunities. Users can deposit USDC into liquidity pools on platforms like Uniswap, Curve, or Balancer, where it is paired with other assets to facilitate trading. In return, liquidity providers earn a share of trading fees and may receive additional rewards in the form of native platform tokens. Some farms also offer boosted yields through incentives like staking LP (liquidity provider) tokens or auto-compounding strategies. While yield farming can generate high returns, it comes with risks such as impermanent loss, smart contract vulnerabilities, and fluctuations in token rewards.

Risks Involved in Yield Farming with USDC

While USDC itself provides a stable base, the process of yield farming involves several elements that introduce risks. The stability considerations are twofold: market conditions and platform-specific risks. Yields fluctuate with market demands, and platforms are not immune to threats such as smart contract vulnerabilities or liquidity issues. Engaging with well-established and secure platforms is crucial to minimizing these risks.

Moreover, liquidity provision strategies, such as those utilized with Automated Market Makers (AMMs) like Uniswap V3, can affect returns. If the market price shifts outside a specified liquidity range, it may result in less favorable asset holdings. Therefore, while stablecoins bring an element of calm to the volatile world of cryptocurrencies, careful consideration of these factors is necessary to maximize returns while safeguarding investments.

Earning with Sperax Ecosystem

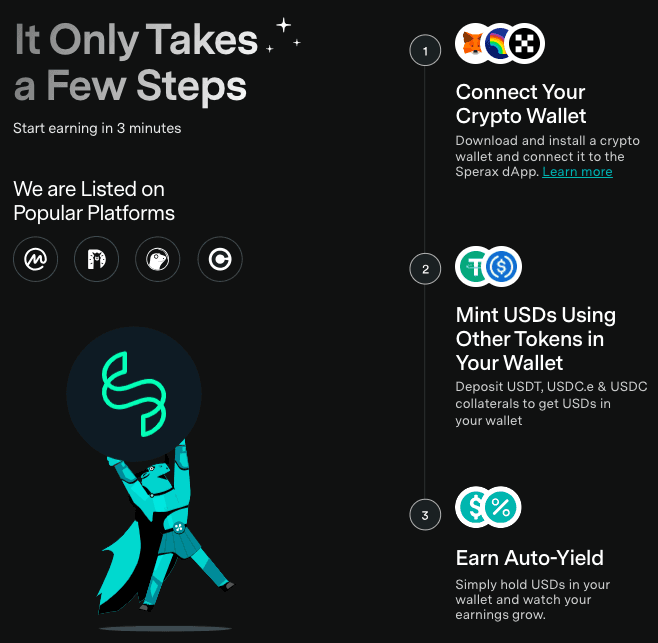

Earning yield on USDC through Sperax's USDs can be achieved via two primary methods:

1. Auto-Yield by Holding USDs

Sperax's USDs is a fully collateralized stablecoin yield aggregator protocol that offers an auto-yield feature, allowing holders to earn passive income effortlessly.

How to Mint USDs: Navigate to the Sperax dApp, connect your wallet, and deposit your chosen collateral to mint USDs.

Earning Yield: Once minted, simply hold USDs in your wallet. The auto-yield mechanism distributes yield, increasing your USDs balance without any additional actions or gas fees. This process is automatic and requires no staking or manual claiming.

The yield comes from various delta-neutral strategies such as Aave, Compound, Stargate and fluid.

2. Providing Liquidity in the USDs/USDC Farm

For those seeking higher yields, participating in the USDs/USDC farm that offers APR>20% is a great option.

By leveraging these methods, you can effectively earn yield on your USDC holdings through Sperax's USDs, choosing the approach that aligns best with your risk tolerance and investment goals.

Role of the Centre Consortium

In the previously structured world of USDC, the Centre Consortium played a pivotal role in governing this popular stablecoin. However, with the dissolution of the Centre Consortium, the baton has been passed entirely to Circle, making them solely responsible for the issuance and governance of USDC. This shift means that any staking or yield-earning activities previously associated with the consortium are now facilitated through other avenues and platforms. For those keen on earning yield with USDC, it's essential to explore these new options to capitalize on the inherent advantages of stablecoins.

Advantages of Using Stablecoins for Earning Yield

High Returns

One major advantage is the potential for higher returns compared to traditional savings accounts. DeFi platforms often provide more lucrative rewards to entice users, making stablecoins like USDC a compelling option for generating passive income without the volatility attached to other digital assets.

Comparative Stability

USDC, being a stablecoin, is inherently less volatile than other cryptocurrencies. This reduced risk profile makes it a calmer and more predictable tool for earning yields. Investors can engage in yield farming without the anxiety of drastic overnight changes in their investment's value.

Low Volatility Experience

Stablecoins allow investors to avoid the wild swings that crypto markets are known for. With USDC, you're less likely to find yourself in the situation where market alterations drastically devalue your investment in a short period. This peace of mind adds a layer of comfort for those who may be risk-averse.

Market Making and Liquidity Provision

Market making and liquidity provision with USDC have gained popularity due to the unique combination of stability and potential for returns. USDC, being a stablecoin, offers the dual benefit of steady value alongside earning opportunities. This makes it a favored choice for those seeking stable yield opportunities without the wild price fluctuations seen in traditional crypto assets.

Potential Fluctuations and Stability Considerations

While USDC provides numerous benefits, engaging in market making and liquidity provision introduces its own risks and considerations. Although stablecoins are primarily stable, the ever-changing dynamics of DeFi platforms regarding supply and demand can cause yield fluctuations, potentially affecting returns.

It's crucial for investors to heed external factors, such as platform-related risks including smart contract vulnerabilities or security issues. Selecting secure and reputable platforms is essential to reduce these risks.

Moreover, the strategies involved in market making, like using Automated Market Makers (AMMs) such as Uniswap V3, necessitate careful planning. Considerations like impermanent loss, where notable token price changes in rewards can lead to unpredictability, emphasize the importance of informed decision-making. If market prices drift beyond the intended range of a liquidity position, liquidity providers may end up with less valuable assets, affecting potential yields.

Staying informed about market conditions and DeFi ecosystem performance is encouraged for investors to manage expectations and minimize risks effectively. With a strategic approach, USDC can offer remarkable opportunities for achieving stable and lucrative yields in the crypto arena.

Risk Management and Considerations

When it comes to earning yield on USDC, understanding the risks involved is crucial. USDC has gained popularity because of its design as a stablecoin pegged to the US dollar, which provides an appealing alternative to more volatile cryptocurrencies. This makes it a preferred choice for yield farming and DeFi activities. However, despite its relative stability, several risk factors must be considered and managed effectively.

Stability and Transparency

The stability of USDC is largely dependent on the transparency and safety of its reserves. USDC's backing by transparent reserves is a key factor in maintaining user confidence and trust. These reserves primarily consist of cash, short-dated US Treasuries, and other liquid assets, regularly verified through attestations by independent auditors. This financial transparency is essential to minimize risks related to reserve issues, ensuring that the stablecoin maintains its intended value.

Market Dynamics

Even stablecoins are not immune to broader market dynamics. For instance, interest rates offered on USDC can fluctuate depending on demand within crypto markets. This means that during high demand periods, yields may increase, but they could decrease when demand wanes. This is notably significant for investors seeking predictable income streams, as relying solely on historical yield rates may not always be a safe bet.

Regulatory Risks

Additionally, regulatory risks are always a factor to keep in mind. While USDC is known for its compliance with rigorous standards, future changes in regulations could affect its use and market dynamics. Staying informed about regulatory updates is crucial for those invested in stablecoin yield activities. The reliance on a centralized entity like Circle for reserve management introduces counterparty risk, though this can be managed with a solid understanding of the underlying guarantees and collateralization.

Technical Perspective

From a technical perspective, smart contract risks represent another potential vulnerability in DeFi. Yield farming with USDC often involves engaging with smart contracts, and any flaw in these contracts can lead to exploits, resulting in potential losses. Therefore, it is essential to research platforms thoroughly and consider using hardware wallets and multi-signature setups to secure holdings further.

Market Liquidity

Lastly, market liquidity and transaction costs on underlying blockchains can influence the overall efficiency of using USDC. While transaction costs for stablecoins like USDC are generally low, significant market events can impact liquidity and costs, potentially affecting transaction speed and yield farming outcomes.

In summary, while USDC provides an attractive option for stable and potentially high returns, investors must remain vigilant about risks such as market dynamics, regulatory impacts, smart contract vulnerabilities, and liquidity issues. By being aware of these considerations and employing sound risk management practices, investors can better navigate the landscape and optimize their yield-earning strategies. For more insight into yield opportunities on USDC, Reddit discussions like those hosted on r/defi offer community perspectives and additional information on yield optimization.